Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Policy Program

Relevance of Affordable Home Insurance Policy

Protecting budget-friendly home insurance policy is critical for securing one's residential property and monetary well-being. Home insurance policy supplies protection versus different risks such as fire, theft, all-natural disasters, and individual responsibility. By having a detailed insurance coverage plan in place, home owners can feel confident that their most substantial investment is protected in case of unexpected circumstances.

Budget-friendly home insurance coverage not only gives monetary safety however also provides satisfaction (San Diego Home Insurance). Despite increasing home worths and building and construction costs, having a cost-effective insurance coverage guarantees that home owners can quickly restore or repair their homes without dealing with significant economic problems

Furthermore, affordable home insurance policy can likewise cover personal belongings within the home, supplying compensation for items harmed or taken. This coverage prolongs past the physical framework of your house, securing the materials that make a home a home.

Insurance Coverage Options and Purviews

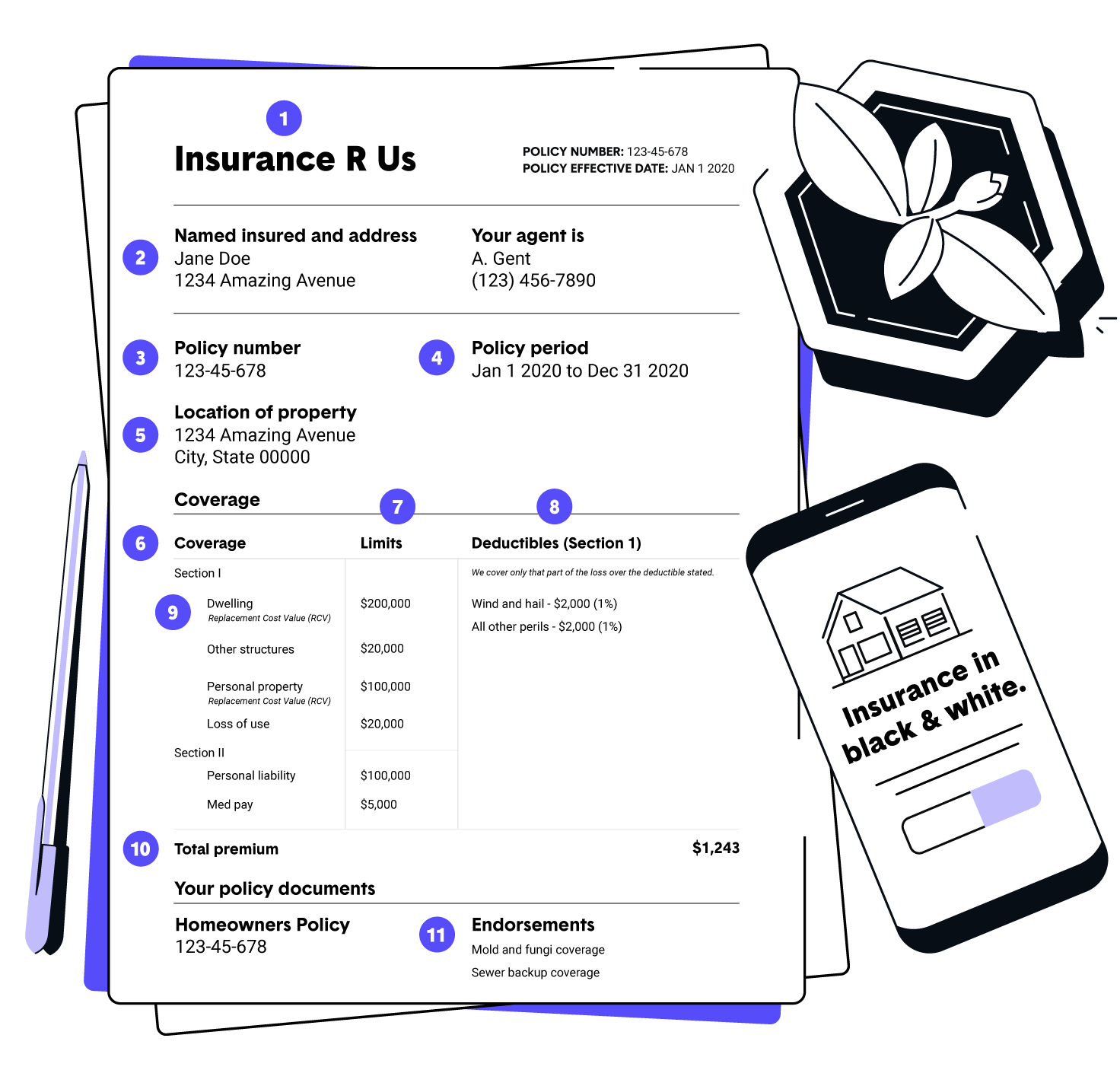

When it pertains to coverage limits, it's vital to recognize the maximum amount your policy will certainly pay for each and every sort of insurance coverage. These limits can vary depending on the policy and insurance company, so it's crucial to assess them meticulously to ensure you have appropriate defense for your home and properties. By understanding the coverage choices and restrictions of your home insurance coverage, you can make informed decisions to safeguard your home and loved ones effectively.

Variables Impacting Insurance Coverage Expenses

A number of variables significantly affect the costs of home insurance coverage policies. The place of your home plays an important duty in figuring out the insurance costs.

Moreover, the type of insurance coverage you choose directly influences the expense of your insurance view it coverage plan. Deciding for added protection alternatives such as flood insurance coverage or earthquake coverage will certainly increase your costs.

In addition, your debt score, asserts background, and the insurer you select can all influence the cost of your home insurance policy. By considering these factors, you can make informed choices to aid handle your insurance coverage sets you back efficiently.

Comparing Carriers and quotes

Along with contrasting quotes, it is critical to evaluate the reputation and financial stability of the insurance coverage companies. Try to find consumer reviews, ratings from independent companies, and any type of background of grievances or regulative activities. A trusted insurance policy provider ought to have a great performance history of quickly refining claims and supplying exceptional client service.

In addition, think about the details coverage attributes view it supplied by each copyright. Some insurance companies might use added advantages such as identity burglary protection, tools malfunction coverage, or protection for high-value things. By very carefully comparing quotes and service providers, you can make a notified choice and choose the home insurance strategy that best satisfies your demands.

Tips for Minimizing Home Insurance Coverage

After completely comparing quotes and service providers to discover the most suitable insurance coverage for your needs and spending plan, it is prudent to discover effective approaches for saving on home insurance policy. Numerous insurance policy business supply discount rates if you acquire several plans from them, such as combining your home and auto insurance policy. On a regular basis assessing and upgrading your plan to show any changes in your home or scenarios can ensure you are not paying for coverage you no longer requirement, assisting you save cash on your home insurance coverage costs.

Final Thought

In verdict, protecting your home and liked ones with cost effective home insurance is important. Executing ideas for conserving on home insurance policy can additionally help you protect the pop over to this web-site essential defense for your home without damaging the bank.

By deciphering the details of home insurance policy strategies and exploring practical strategies for safeguarding cost effective protection, you can make sure that your home and enjoyed ones are well-protected.

Home insurance plans normally supply a number of protection choices to protect your home and valuables - San Diego Home Insurance. By understanding the protection choices and limits of your home insurance policy, you can make educated choices to protect your home and enjoyed ones successfully

Frequently assessing and upgrading your policy to reflect any kind of adjustments in your home or situations can guarantee you are not paying for protection you no longer requirement, helping you conserve money on your home insurance coverage costs.

In conclusion, safeguarding your home and enjoyed ones with inexpensive home insurance is important.